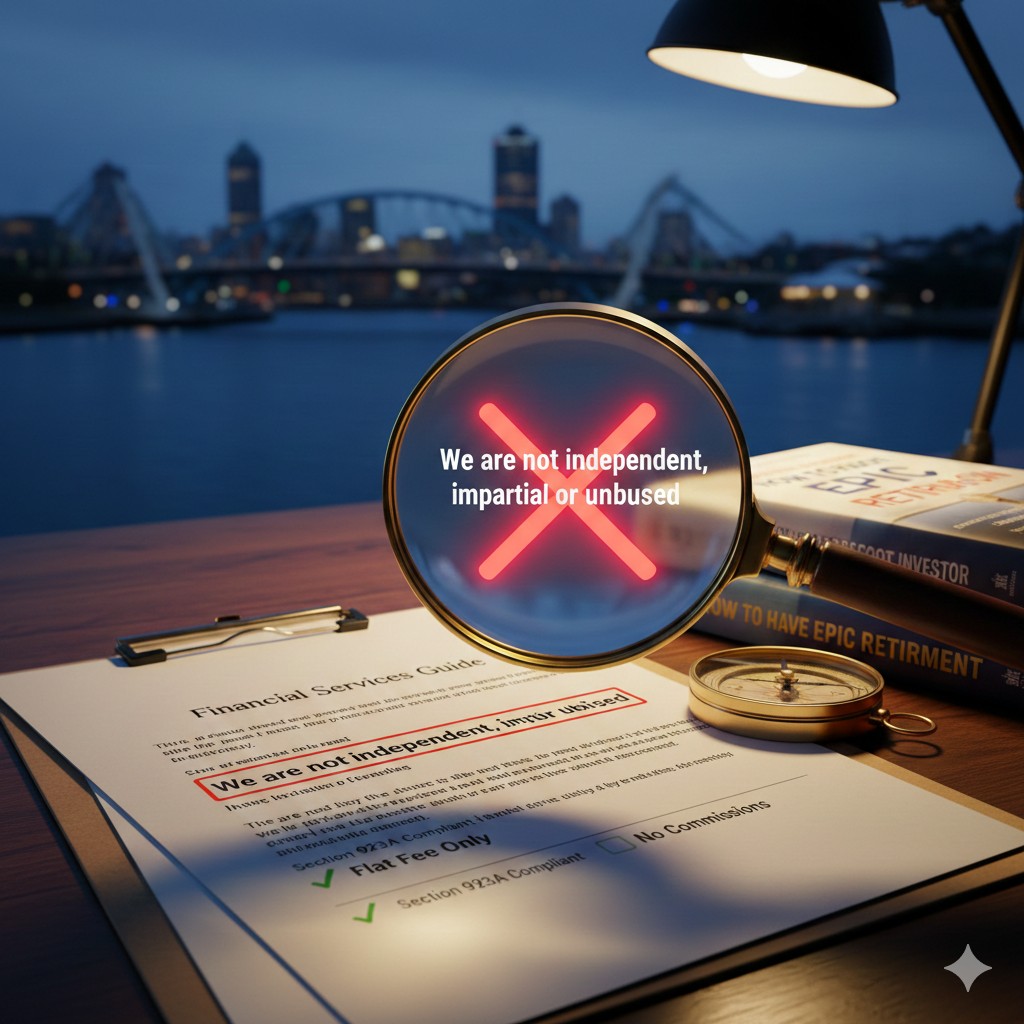

Is Your “Independent” Financial Adviser Genuinely Independent? (A Newcastle Review)

Most people assume financial advice is independent by nature. The reality is very different.

When someone searches for “independent financial advice in Newcastle,” they expect a list of genuinely unbiased advisers. What they encounter instead is marketing language and a legal definition that very few local businesses actually meet.

From Parenting to Prosperity: Your 2026 Financial Plan

The house is quieter, the calendar is clearer, and the "family budget" is no longer being drained by school fees or weekend sports. For many Australians aged 50–55, 2026 marks the start of a high-stakes decade. You are likely in your peak earning years, but with a national median dwelling value now sitting at $873,000 and global market volatility, the "old" way of preparing for retirement isn't enough.

Are You Really a “Sophisticated Investor”? Or Just Wearing the Fancy Hat?

Planning your retirement should feel exciting, long lunches, road trips, maybe a caravan adventure around Australia. But lately, more everyday Australians are being told:

“You’re a sophisticated investor!”

Sounds glamorous, right? Like you should be sipping champagne on a yacht.

💥 Retirement Reality Check: Is Confusion Costing You $136,000? Get Simple, Smart Advice in Newcastle.

Retirement should be a time of freedom and fulfillment, not confusion and stress. Yet for many everyday Australians, navigating the transition from earning to living off savings feels overwhelming. The complexity of the retirement phase can cost a typical retiree up to $136,000 in lost benefits over their lifetime.

🎯 Retire with Confidence: Stop Guessing, Start Growing

At Finspire Advisers, we believe retirement should be a time of freedom, purpose, and financial certainty—not stress or guesswork.

Yet, according to leading industry research, including Vanguard How Australia Retires-2025 many Australians are facing a growing gap between their retirement expectations and reality.

The Great Rebalancing: Navigating Today's Market with Caution

Over the past few months, we've had a lot of clients ask us about the headlines on interest rates and market volatility. It's a great question, and it's why we're writing to you today. At Finspire Advisers, our role is to help you understand the big picture so you can feel confident and in control of your financial journey.

Planning the Whole Course, Not Just the Next Shot

Life doesn’t come with a manual. And even if it did, it wouldn’t include the chapter on superannuation legislation, tax offsets, or Centrelink thresholds. That’s why ongoing financial planning isn’t just a one-off swing, it’s like having a trusted caddy by your side, helping you navigate the course with confidence.

Thinking of Moving Your Super? Why You Might Be Better Off Staying Put

It’s completely normal to feel a bit of pressure when it comes to your superannuation. Whether you’re approaching retirement, starting a new job, or simply looking to optimise your savings, you may have been presented with a recommendation to move your money into a managed account structure, such as a Separately Managed Account (SMA) or a Managed Discretionary Account (MDA).

Popular Ways Australians Invest – Which Strategy (or Combination) Suits You Best?

Thinking about growing your wealth but not sure where to begin?

Whether you're paying off a mortgage, growing your super, investing in shares, or considering borrowing to invest, or a combination of all four — this guide will help you understand your options.

Super Charge your Retirement: Opportunities in 2025–26

The new financial year has arrived, and with it comes a wave of superannuation updates that could significantly impact your retirement planning. Whether you're just starting to build your super or approaching retirement, understanding these changes is key to making informed financial decisions.

💡 Advice Fees - What you need to know

Your professional fee isn't just a cost; it's an investment in your financial future. It reflects the value of personalised advice, strategic planning, and ongoing support, helping you achieve your goals with confidence.

At Finspire Advisers, we're committed to providing clear, tailored financial advice that supports your aspirations and gives you confidence in your decisions. A key part of that commitment is ensuring you fully understand how our fees work, what they cover, and your payment options.

New Year, New Rules: What 1 July Means for Your Money

With the arrival of 1 July, the financial landscape is shifting, bringing new rules, new opportunities, and important updates that could influence your financial future. From superannuation and pensions to business regulations and household costs, understanding what’s new is key to staying ahead.

At Finspire Advisers, we believe that informed decisions lead to financial confidence. That’s why we’ve broken down the most important updates taking effect from 1 July 2025, so you can make the most of the opportunities and navigate the challenges with clarity.

Defined Benefit Retirement Planning

Your Retirement Crossroads: Navigating Your Defined Benefit with Confidence

You've spent years building a solid defined benefit, a testament to your long-term planning. Now, as retirement approaches, a new set of questions and anxieties may arise. This is where an Independent Financial Planner can support you. You're moving from the predictable world of a formula-based benefit to the complexities of managing your retirement funds – a significant shift that can feel daunting. Let's address those concerns head-on and map out a path to a secure and fulfilling retirement.

What is “Market Volatility”?

Ever heard the term 'market volatility' and felt uneasy? Discover what it means and how it impacts your investments. Learn how Finspire Advisers can help you navigate these fluctuations to maximize your financial growth. Book a complimentary call with an Independent Financial Planner today.

Let’s Maximise Your EOFY Benefits for 2025

Australian Dollars with 3D 'EOFY' letters, highlighting the transition from 2024 to 2025. The numbers '4' and '5' are slightly disappearing, symbolizing the end of one financial year and the start of another.

Choosing the Right Superannuation Fund in 2024

Embark on a stress-free holistic financial planning journey with Finspire Advisers. Discover how to choose the perfect superannuation fund with no hidden fees, no commissions, and no pressure. Let us help you achieve your retirement dreams with clarity and confidence.

Investment wisdom of Charlie Munger: Strategies for Long-Term Success

Discover the investment wisdom of Charlie Munger, vice president of Berkshire Hathaway. Learn key strategies for long-term investing, the importance of patience, and how to minimize the “behavior gap” in your financial journey."